The Four-Week Cycle: Why the Bull Strangle Requires Only Minutes a Week

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 76%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Overview

One of the most overlooked advantages of the Bull Strangle strategy is how little time it takes to execute consistently. Many investors mistakenly assume that a sophisticated income framework requires constant monitoring, frequent adjustments, or fast reflexes. The truth is quite the opposite: the Bull Strangle thrives on discipline, structure, and simplicity — not on day-to-day tinkering.

A Once-a-Week Routine

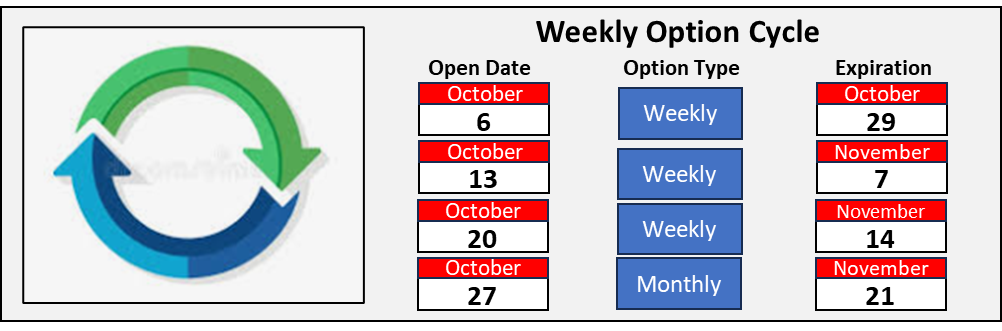

The Bull Strangle operates on a fixed cycle: trades are placed every Monday and set to expire exactly four Fridays later. This structured, four-week rhythm eliminates guesswork and reduces emotional decision-making. By following this schedule, investors create a repeatable system of premium collection without needing to watch every tick of the market. Unlike strategies that require constant screen time, intraday adjustments, or complex hedges, the Bull Strangle is designed to be put on once a week and left alone.

The Monday Routine

Executing the Bull Strangle strategy can be distilled into a simple three-step Monday routine that rarely takes more than a few minutes:

1. Close Out Remaining Trades

Any trades not called away on the previous Friday should be closed. This resets capital and ensures a clean slate going into the new cycle.

2. Review the Watch List for Diversification

Next, examine the stock watch list. Selection is not random — the goal is to maintain sector diversification and avoid overconcentration. If certain sectors are already represented in existing positions, new trades should be drawn from different areas of the market to balance exposure.

3. Initiate the New Trades

Once the watch list is reviewed and selections are made, place the new trades for expiration four Fridays later. This completes the process for the week, allowing investors to step away until the next cycle.

Minimal Maintenance, Maximum Efficiency

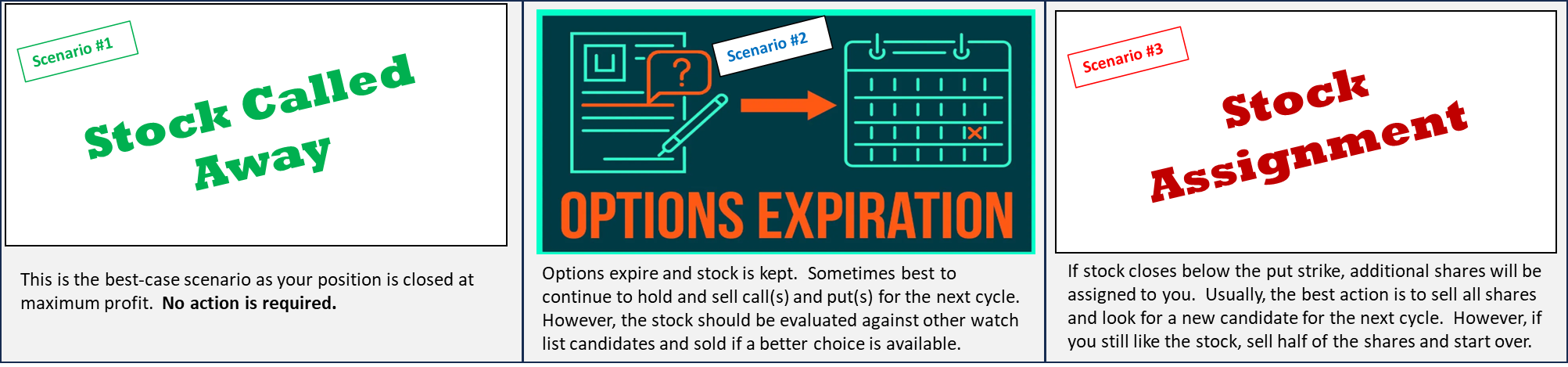

After placing the trade, no additional action is required unless an option happens to be exercised early. Even then, the process is straightforward: covered calls may trigger a sale of stock or cash-secured puts may trigger a stock purchase — both outcomes that are fully anticipated in the design of the strategy. For most weeks, however, trades simply run their course until expiration, where the income from sold options is realized and the cycle begins again.

Why Less Time Means Better Results

Paradoxically, doing less often leads to better outcomes. By avoiding the temptation to constantly intervene, investors allow the systematic edge of premium collection to play out. The discipline of trading once per week ensures consistent execution, preserves the compounding effect of rolling option income, and reduces the emotional pressure that comes with more hands-on trading. In practice, this means investors can run a professional-grade strategy while spending only a few minutes per week placing trades.

Conclusion

The Bull Strangle strategy proves that generating income from options doesn’t have to consume your time or your focus. With a simple Monday routine, a fixed four-week expiration, and no need for daily adjustments, the framework delivers both efficiency and consistency. For investors seeking reliable returns without the grind of constant market-watching, the Bull Strangle offers a disciplined, time-efficient path to long-term success.

More Information

For a short video explaining the Bull Strangle strategy.

For a more detail on the strategy

To subscribe to the Bull Strangle Newsletter

Contact

Darren Carlat

Managing Director

Darren@SpreadEdgeCapital.com

(214) 636-3133

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.