This Dividend ETF Is a Great Way to Find High-Yield Stocks. Here Are 3 I’m Watching Now.

Investing in stocks primarily for yield has been in a slump. It has been quite a while since the “sexy” part of the stock market focused on tickers whose best side is their high, consistent, and enduring dividend payouts.

Dividend stock investing – with the dividend as priority – may not be making a loud comeback. And I’m not even giving much mind to that “dividend growth” factor, which is really growth stocks disguised as income vehicles. I’m talking about a yield that is well above T-bill rates, but is not distributed by a company whose stock is in the process of collapsing.

Because in this market that increasingly looks like it is on borrowed time, one thing investors and traders do not need is stocks that tease them with high dividend yields, but which have high risk of price damage.

How to Find High-Yielding Stocks with Price Gain Potential

This is but one article, with limited space. But since I always try to embed a broader, timeless investment concept in my work here, consider this. I’m going to show a screen I did on Barchart.com, using one ETF that holds 50 stocks of companies with high dividend yields and a history of lower volatility. The operative word there is “history,” since so many traditional high-yield stocks that investors have counted on for decades have fallen so hard in price that it will take 5-10 years of dividend payments just to make it up.

My Top Dividend Investing Rule: Don’t Chase Yield and Ignore Price Risk

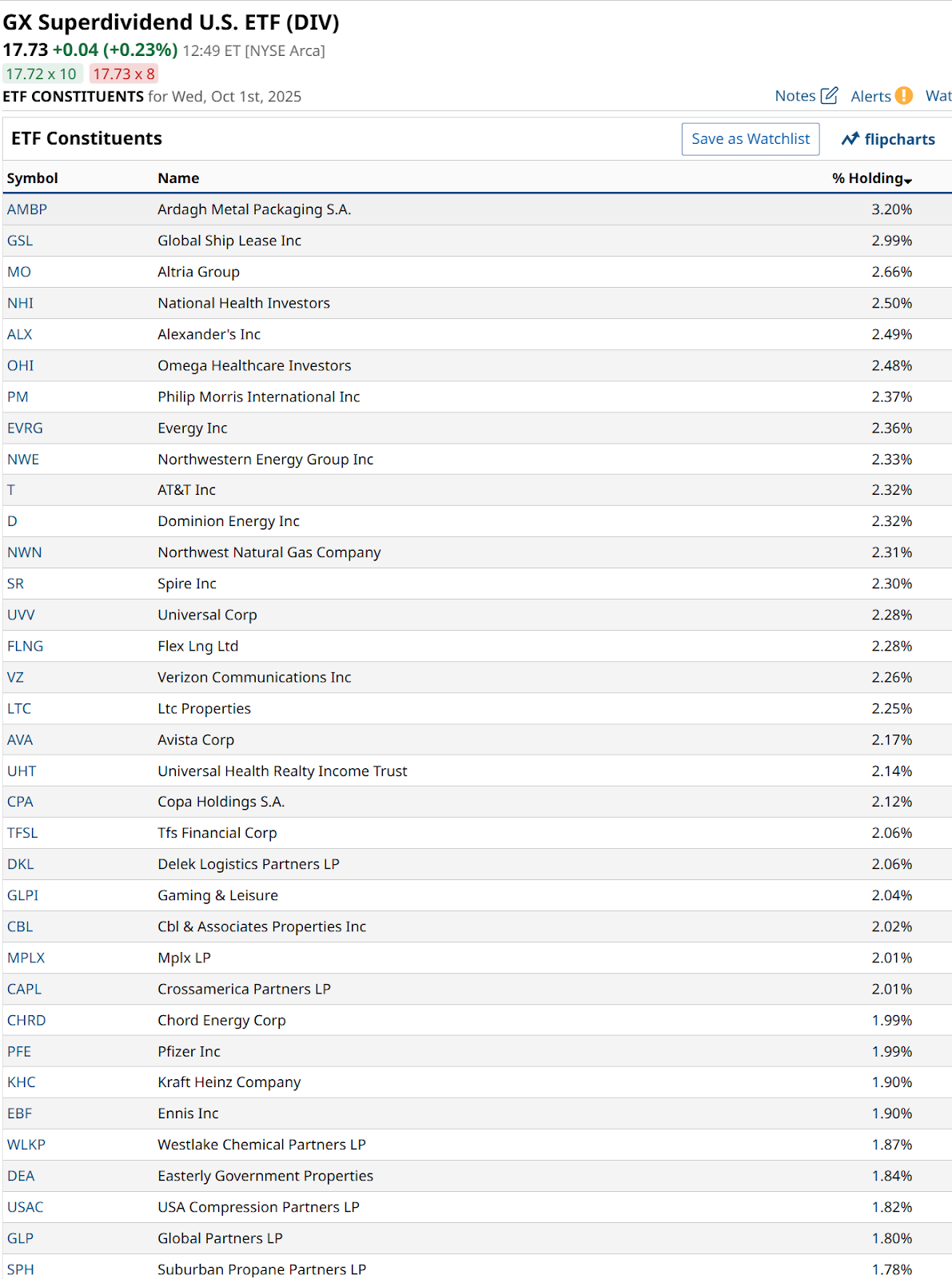

I am using one ETF in particular, the $647 million in assets Global X SuperDividend US ETF (DIV), one I’ve analyzed and owned several times in the past during its 12 years of existence (but not currently). But you can apply this same process to any ETF, even those not focused primarily on dividend yield. For instance, you could look at the entire S&P 500 Index ($SPX), and decide that’s your “playground” for finding stocks with yield.

With DIV and many other dividend-driven ETFs, I know that the stock portfolio can be used as a screening tool as well. So while on the surface, a portfolio selling at less than 11x trailing earnings and yielding 6.7% is quite intriguing, the mission here is to cherry-pick. I’m looking for the 3 stocks within those 50 held by DIV that not only have a nice “sticker price” when it comes to their dividend yield right now. I’m also doing my usual “risk manager” thing by charting them all, in search of a few that I think have the best shot at paying me well in one hand, without the other hand stealing that income and then some, as the price drops by much more.

You can find the full holdings list for any ETF by clicking on constituents from the ETF’s profile page. When I do that for DIV, it shows all of them, beyond what you see in this snapshot below. This gives us an idea of what we’re going to find in this fund’s holdings. A mix of fairly sleepy stocks in many sectors which play a small role in the S&P 500 and Nasdaq 100 ($IUXX) indexes. There’s more consumer staples and other slow earnings growers here. That’s typically the tradeoff with dividend investing.

What Traders May Miss When Scouting ‘Boring’ Dividend Stocks

If total return is important to you (and if not, why not?!), your focus should be on analyzing your holdings for their potential to produce some price gains to supplement high dividend payments. And, to do so with lower-than-average risk of loss. That’s my approach to staying out of trouble over short periods of time, while taking in that precious income from my stocks. So with the ground rules now in place, here are three stocks from this list that combine a high yield and a favorable chart pattern. I’m using daily charts, so this can be relevant to both investor and trader time frames.

For the latter, keep in mind that the dividend is only paid every 3 months for most stocks, and you have to own the stock on the “ex dividend date” to qualify to receive it. Also remember that dividends reduce the stock price on that ex-date. Dividends are, after all, a distribution of profits from a stock, not some sort of bonus gift.

These 3 High-Yield Stocks Have Bullish Chart Patterns Too

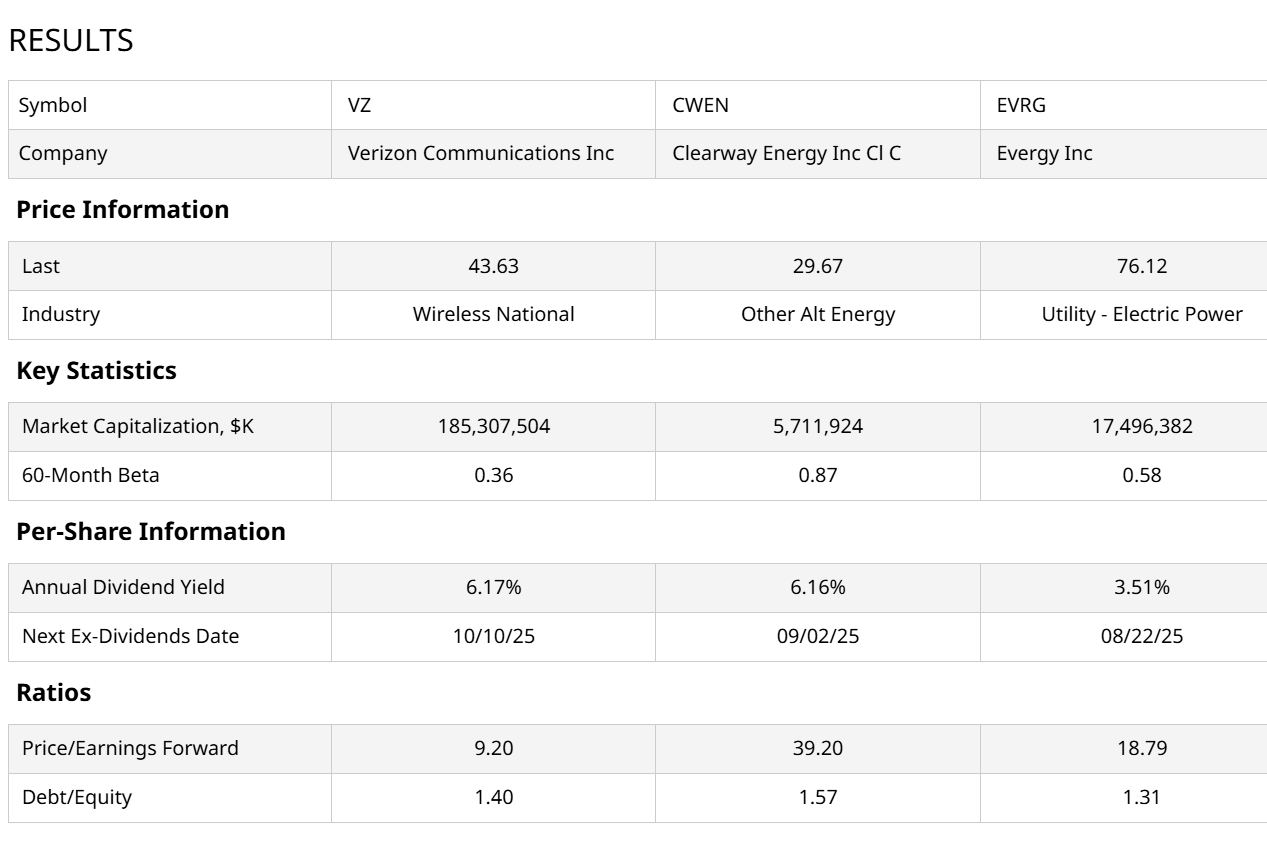

Using the stock comparison tab, I selected these three stocks, with the charts to follow below. Verizon (VZ) is by far the biggest and most recognizable of the trio. The DIV ETF casts a wide net, and its average stock is smaller than an S&P 500-type screener. Clearway Energy Class C (CWEN) is focused on alternative energy, and stocks in that market area are getting a bid lately.

And Evergy (EVRG) is a Midwest U.S. electric utility whose history dates back to when it was known as Westar, and prior to that Kansas City Power and Light. It is no surprise to find utility stocks in an ETF like DIV.

Their earnings multiples vary greatly, but their historical betas are all under 1.00, which signifies that they’ve each been less volatile than the S&P 500 over the past 5 years.

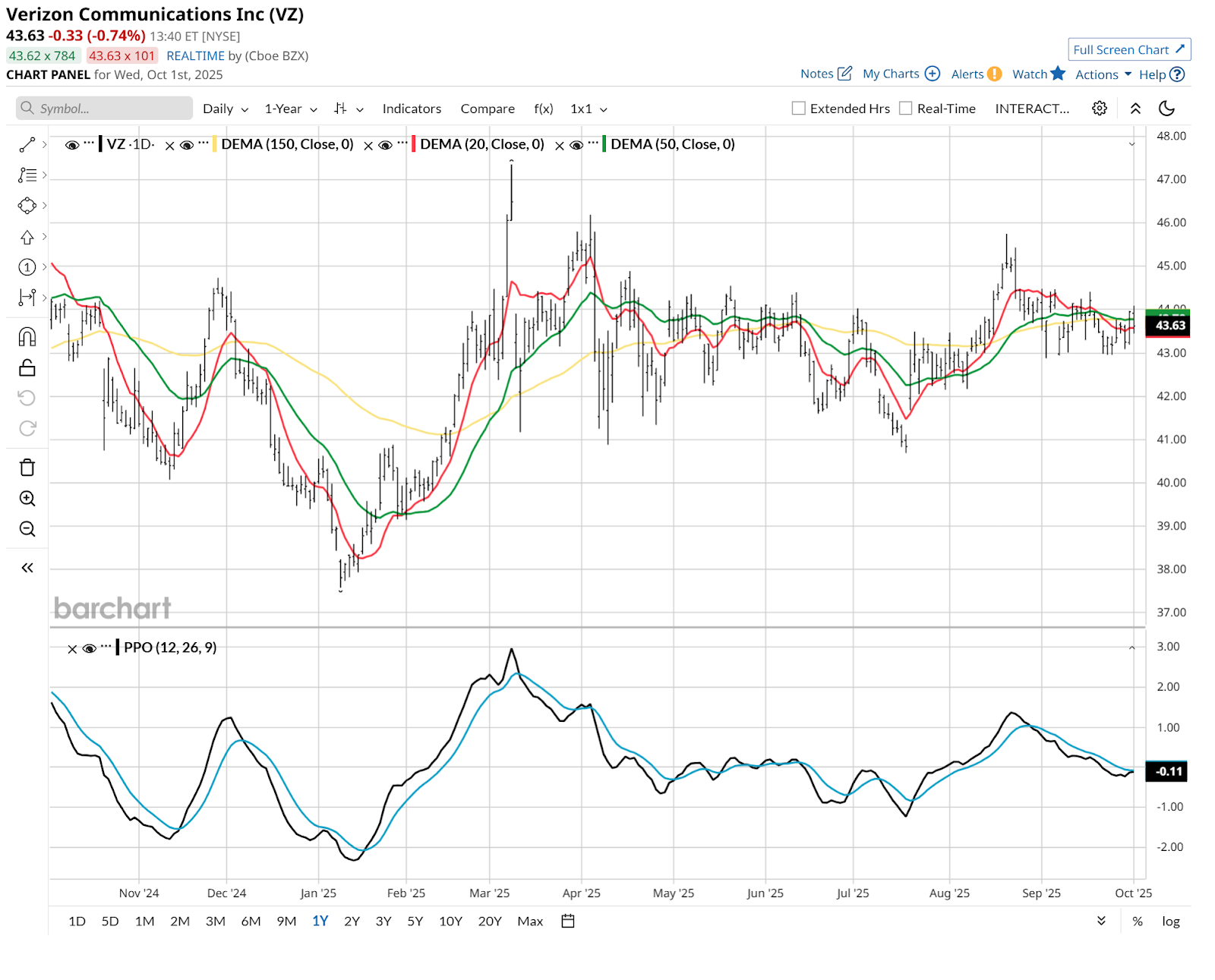

VZ’s chart looks as it often does: like its return above its 6.3% yield will be modest. But if a dividend investor can get that type of yield plus a bit of capital appreciation, that’s not bad in this frenzied market.

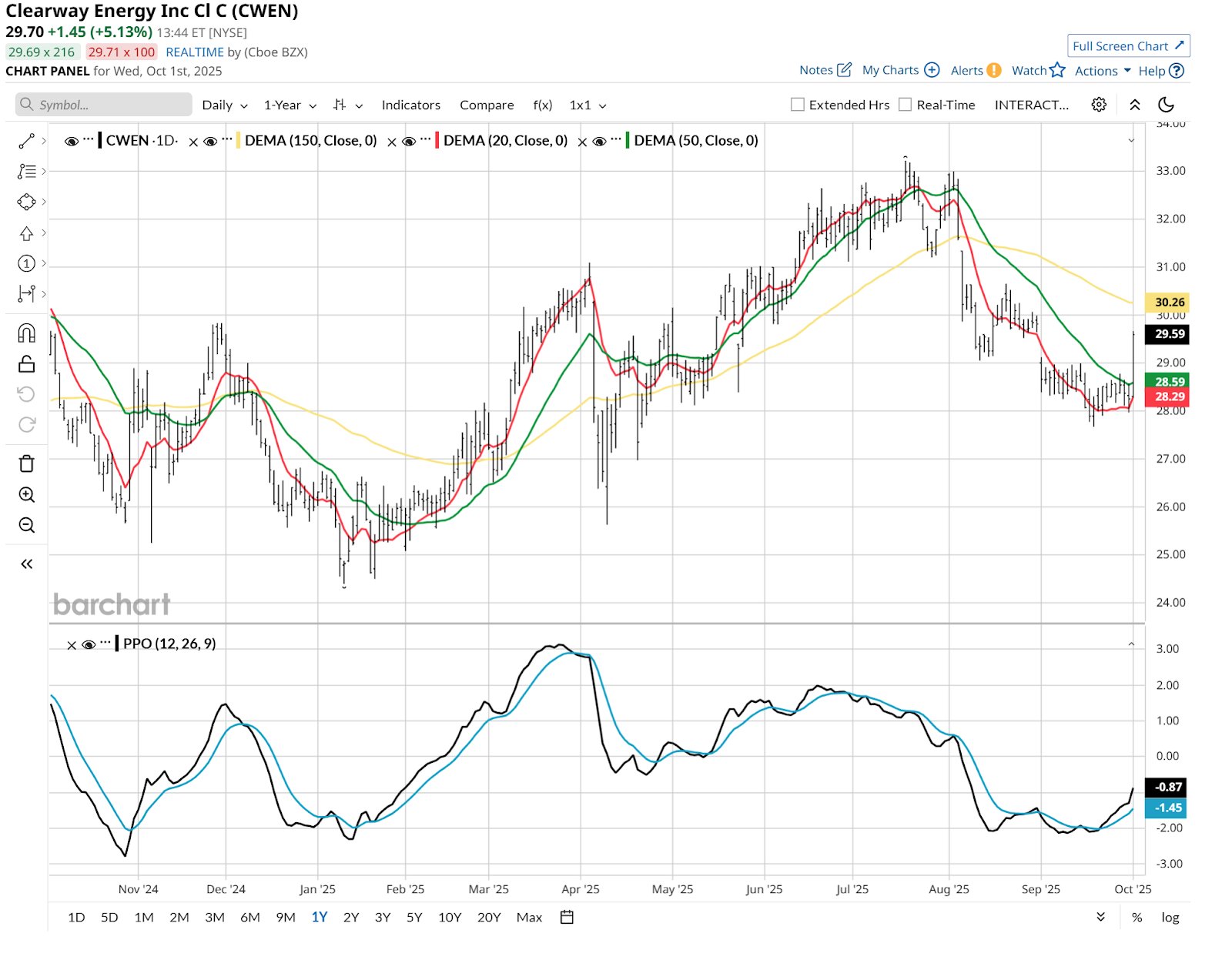

CWEN is showing signs of taking a run at its recent high around $33 a share, 10% up from where it traded on Tuesday afternoon. That would make for a nice total return on top of an annual yield north of 6%.

I put EVRG last for a reason. It only yields 3.5%. However, that it was one of a small number of DIV stock holdings that have promising stock charts is as much an indictment of the dividend yield space as I can think of. And it is a great example of how dividend investing today often requires some tradeoffs, since many high yielders simply keep delivering massive price erosion to shareholders. That defeats the purpose of total return dividend investing. The other reason EVRG’s yield is that low is it is way up this year, and just broke out, now approaching its 2020 all-time high price. Higher price means lower yield.

Dividend Investing Is Changing, So Let’s Change with It

Dividend investing is great in concept, and it is always a good time to scout for winners. But in this current environment, I think the bar for what passes for good, yield-focused total return investing has to be set very high.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.