WALSH PURE SPREADER - Pure Hedge Division

WALSH PURE SPREADER

Pure Hedge Division

Rich Moran 9/5/2025

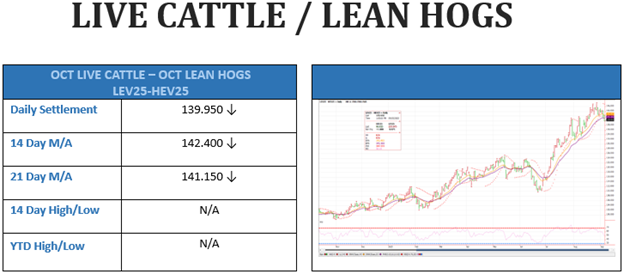

Oct Live Cattle-Oct Lean Hogs Spread (LEV25-HEV25)

Since August 1st, I have had us keeping an eye on selling the Oct Live Cattle versus buying the Oct Lean Hogs (LEV25-HEV25) spread. This spread has been on a steady uptrend since the end of June, but it started to slightly fall off in the middle of August. I have been writing about waiting for the spread to fall below and settle below both the 14-day and 21-day moving averages. That finally happened today.

I think by selling this spread, we might have a nice way, or should I say a “more comfortable” way, to slip some Live Cattle shorts into our position.

Today, LEV25-HEV25 settled at 139.950, the low of the day. This is about 1.000 below the 14-day moving average and about 2.500 below the 21-day moving average.

If LEV25-HEV25 is still below these moving averages when the market opens Monday morning, I suggest trying to get short the spread (selling Oct Live Cattle versus buying Oct Lean Hogs) at 139.900 or better.

Risk 6.000 or $2,400 Per Spread to make 18.000 or $7,200 Per Spread, plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Following up on the still active past trade ideas:

- 9/3/25: ZMZ25-ZMH25 (DEC-MAR Soybean-Meal Spread)

Today’s settlement: -9.5, Long at -10.2

On Wednesday I suggested trying to get long the ZMZ25-ZMH25 Spread at Wednesday’s settlement of -10.2 or better when the market reopened for Thursday market. The opening was -10.2 and it traded -10.3, so we are long at -10.2.

We are risking 1.3 dollars (-11.5) or $130 Per Spread to make 5 dollars (-5.2) or $500 Per Spread, plus fees and commissions.

- 8/29/25: ZCZ25-ZCH26 (DEC-MAR Corn Spread)

I think we should try getting long the ZCZ25-ZCH26 (DEC-MAR Corn Spread) if we can settle above the 14-day and 21-day moving averages. Today, we settled about 1 cent below both moving averages.

- 8/27/25: ZSF26-ZSN26 (JAN-JULY’26 Soybean Spread)

If we can get back above and settle above the 14-day and 21-day moving averages, I think we should try buying the spread with a short stop below these moving averages.

Today, we settled about 2 cents below these two moving averages again.

- 8/6/25: ZSX25-ZSF26 (NOV-JAN Soybean Spread)

Today’s Settlement: -18½, long at -17½

The spread settled above the 14-day and the 21-day at -17¾ on 8/21/25. You should be long at -17½ from the open on 8/22/25.

Risking 3½ cents (-21) or $175 to make 9 ½ cents (-8) or $475

- 8/1/25: LEV25-HEV25 (OCT’25 Live Cattle-OCT’25 Lean Hogs Spread)

Wednesday’s Settlement was 144.50. I said if we are fortunate enough to have this spread, LEV25-HEV25, settle below the 14-day and 21-day moving averages, I think it could be a good time to short it. It just might be a more comfortable way to slide some Live Cattle shorts into our position.

Today’s article is about this spread …. See above.

- 7/23/25: ZWZ25-ZWH26 (DEC’25-MAR’26 Wheat Spread))

Today’s Settlement: -16½, long at -18½

Risking 3½ cents (-22) or $175 Per Spread to make 10 cents (-8½) or $500 Per Spread, plus fees and commissions.

If you have any thoughts/questions on this article or any questions at all in regard to the commodities futures markets, please use this link Sign Up Now

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298

Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.