Walsh Corn Opportunities - Pure Hedge Division

Corn has a disappointing close today to end the week. December corn made a high at 424 3/4 this morning, but ended up closing at 418, down 1 3/4 cents. In my article on Wednesday, I mentioned the possibility of more short covering with a close over 420. Last week managed money bought 33,964 corn contracts. Today’s Commitment of Traders report showed managed money traders bought 19,199 contracts, bringing their net short position in corn to -91,487. 418 is proving to be a significant resistance level, right on the trendline from the April high. If corn trades lower early next week, I see it as an opportunity to enter bullish options positions.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

The Pro Farmer Crop Tour took place in Indiana, Illinois, Iowa, Minnesota, and Nebraska, starting on August 18 and concluding on August 21. 1,579 corn samples were taken; 52.2% were above 192.42 (bushels per acre) bpa, while 47.8% came in below. Pro Farmer estimates corn yield at 182.7 bpa and production from 16,042 (billion bushels) bb to 16,366 bb, compared to the USDA’s yield estimate at 188.8 and production estimate at 16,742 bb on the August WASDE report. StoneX estimates yield at 186.9 bpa and corn production at 16,577 bb. Ear counts were higher in comparison to the 3-year average in Indiana, Iowa, Minnesota, Nebraska and South Dakota. Grain length was higher than the 3-year average in all crop tour states.

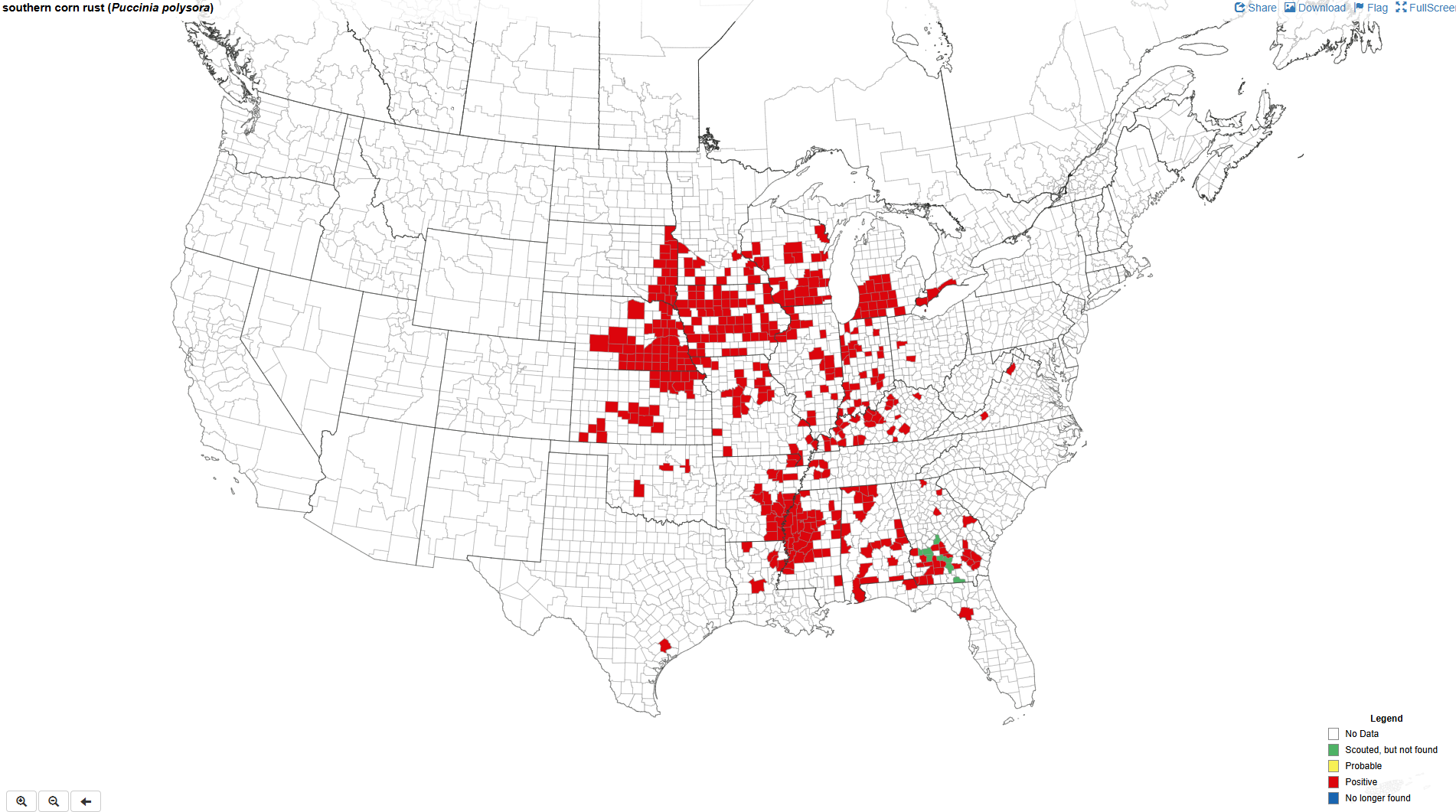

This year’s crop tour had very high expectations due to favorable growing conditions, but Pro Farmer mentioned seeing a surprising amount of disease. One Pro Farmer economist mentioned seeing more disease pressure than ever before. Warm and wet conditions were great for fueling growth but also gave tar spot, northern blight, and southern rust a chance to develop. While Wisconsin was not part of this year’s crop tour, tar spot has now been confirmed in 28 Wisconsin counties. Disease pressure is something to keep an eye on going forward as harvest gets closer. The next WASDE report is scheduled for September 12.

Total corn sales for the week ending August 28 were 1,836,057 metric tons at 28.6% of the USDA estimate and 21.8% of the 5-year average. Top corn buyers were Mexico, Colombia, Japan, Taiwan, Israel, and unknown. Mexico continues to be the top buyer of US corn. Grains exports to Mexico were 6.85 mt in the second quarter, which was 21% above Q1.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

December ’25 CORN

December 450 Call

Buy December Corn 450 Call 4 1/2

Price: 3 3/4 Cost: $187.50 Debit/Trade Package, Plus Fees and Commissions.

December’25 Corn Options Expire 11/21/25 (77 Days)

MAXIMUM LOSS: LIMITED

MAXIMUM GAIN: UNLIMITED

December 440/470 Call Spread

Buy 1 December Corn 440 Call 5 5/8

Sell 1 December Corn 470 Call 2 1/2

Price: 3 1/8 Cost: $156.25 Debit/Trade Package, Plus Fees and Commissions.

December’25 Corn Options Expire 11/21/25 (77 Days)

MAXIMUM LOSS: LIMITED

MAXIMUM GAIN: 30 cents or $1,500/Trade Package minus Premium Paid

December Ratio Spread

Sell 2 December Corn 390 Puts 31 1/8

Buy 1 December Corn 420 Call 12.0

Price: 50 1/4 Cent Credit Cost: $2,512.50 CREDIT/Trade Package, Plus Fees and Commissions.

December’25 Corn Options Expire 11/21/25 (77 Days)

MAXIMUM LOSS: UNLIMITED

MAXIMUM GAIN: UNLIMITED

I would look to exit this trade if corn trades at 389 to limit risk to ~33-36 cents or $1,650-1,800. 392 is the low from early August. This strategy is profitable with corn trading above 390 for the sold puts and additional profits from the bought call will kick in above 420.

March ’26 CORN

March 26' Call Spread

Buy 1 December Corn 440 Call 20 1/2

Sell 1 December Corn 470 Call 9 1/8

Price: 11.375 Cost: $568.75 Debit/Trade Package, Plus Fees and Commissions.

March’26 Corn Options Expire 2/20/26 (168 Days)

MAXIMUM LOSS: LIMITED

MAXIMUM GAIN: 30 cents or $1,500/Trade Package minus Premium Paid

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Hans Schmit, Walsh Trading

Direct 312-765-7311 Toll Free 800-993-5449

hschmit@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.