Grain Spreads: Unknown Destinations Part 2

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

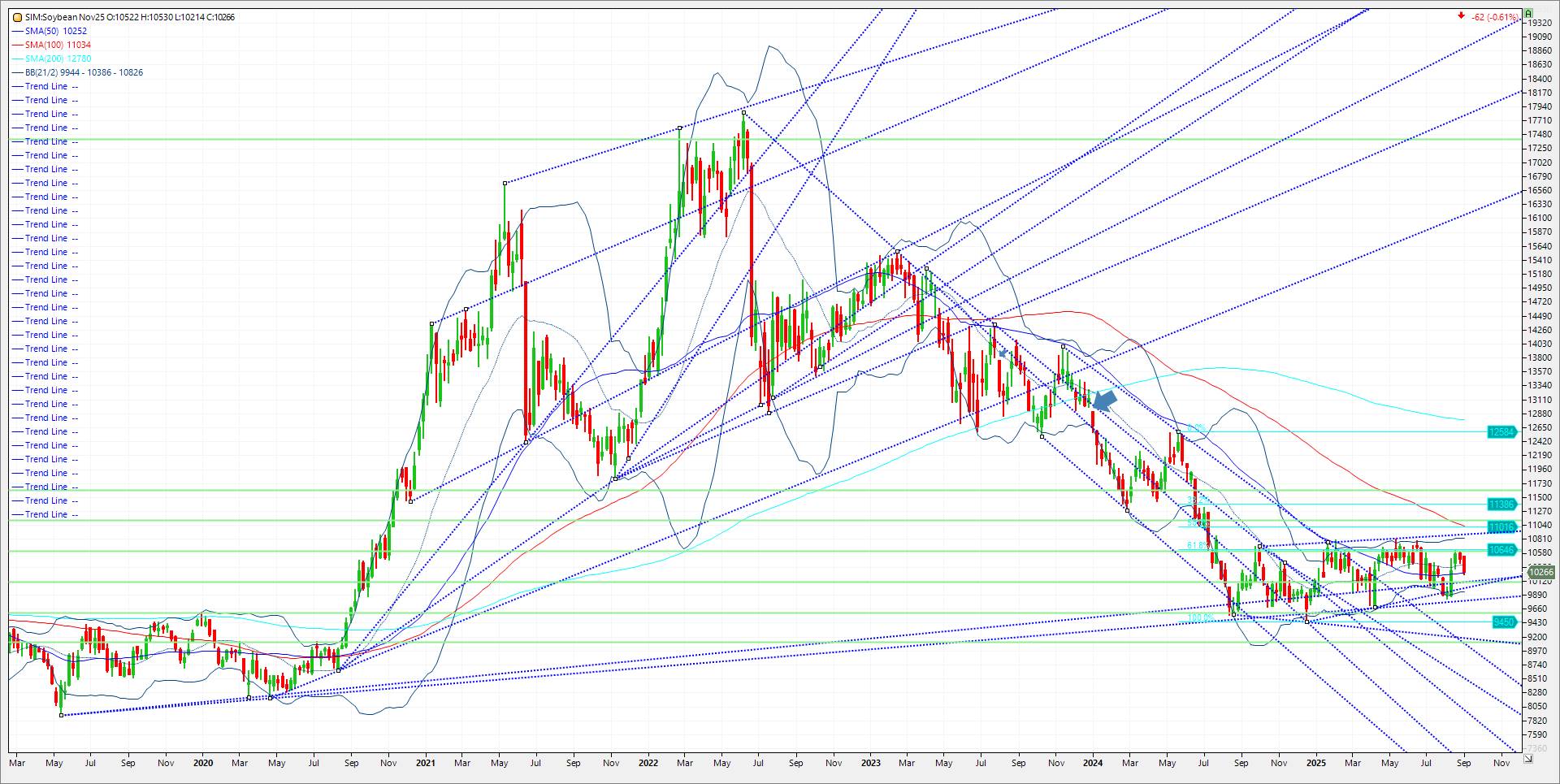

Private exporters reported the following sales activities this week with our old friend Unknown Destinations the headliner. Per USDA, 123,000 metric tons of soybeans were sold for delivery to unknown destinations during the 2025/2026 marketing year. A second sale of 204,650 metric tons of soybeans were sold to unknown destinations during the 2025/2026 marketing year. For the past twenty years, it is my belief that unknown destinations was spelled C-H-I-N-A. To my knowledge that prior assumption has now been debunked within the US export program per every so-called analyst/ crop scout I’ve read. If not China, who is this unknown buyer who has bought over 2 million metric tons of beans for future shipment on the last 4 export sales reports? Along with today’s flash sales release beans to unknown are closer to three million metric tons. The mystery continues in my opinion but I’m not aware of any other major bean buyer outside of China who hides behind the unknown category. I could be missing something here. Short sellers showed up in full force this week after the three-day holiday as demand worries prevailed over supply side concerns. Weakness in the grain sector continues to stymie any rally and, in my view, pressure stemmed from weak action in meal futures, wheat, and late week pressure in corn, which added to the weaker tone. USDA’s weekly bean condition rating declined from 69 to 65 percent this week from disease concerns in the western belt to drought conditions in the Eastern belt. While production concerns certainly loom, a lack of new-crop purchases from China continues to limit both futures and basis. Thank goodness for the demand for future shipment of the unknown buyer or buyers. Technical levels for November soybeans next week come in as follows. Support is at 10.25 and 10.21. A close under both levels could push the market to 10.05 and then 9.95. Resistance is 10.39, the 21-week moving average. Consecutive closes over and the market retests 10.62. Closes over 10.62 and the market could push to 10.82 and then 10.89.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.