Ford Seeks a ‘Model T’ Moment with New EV Platform. That’s Easier Said Than Done.

Ford (F), which achieved scale with its Model T in the early days of the automotive industry, now sees a “Model T” moment in its electric vehicle (EV) business, as it announced a new platform which CEO Jim Farley termed “the most radical redesign of how we manufacture cars since the Model T.” The company is looking to build a $30,000 electric pickup truck, which would be available in showrooms in 2027. Ford announced a $5 billion investment toward the initiative and expects the new models to be profitable from the start.

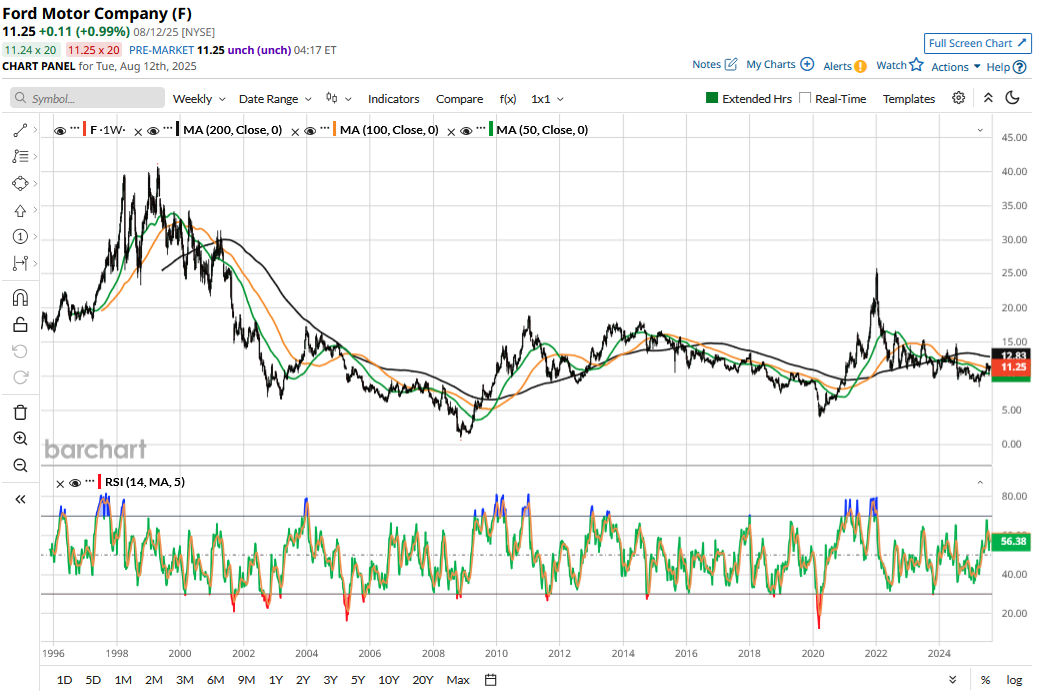

The event failed to move the needle significantly for Ford stock, as markets are no longer as enthusiastic about EV industry developments as they were a couple of years ago. In this article, we’ll look at the challenges as Ford prepares for the next phase in its history with a mass market electric car.

What Made the Ford Model T Successful?

Ford’s Model T was introduced in 1908 and was one of the first mass-produced vehicles. Henry Ford wanted the model to be “affordable, simple to operate, and durable,” and through its cost-efficient moving assembly line process, the company was able to sell the car for between $260 and $850 – a price that helped achieve the stated goal of building a “universal car.” The model was also ahead of its time.

When the Model T was launched, there were an estimated 250 automotive companies in the highly fragmented U.S. automotive market. The industry subsequently saw consolidation, and most companies went defunct.

One of the famous quotes from Henry Ford relates to the Model T, about which he said, “Any customer can have a car painted any color that he wants so long as it’s black.” Between 1914 to 1925, the Model T was only offered in black, which Ford says was “solely for efficiency and uniformity.”

The automotive industry has come a long way since, and customers are now spoilt for choice, not only between cars running on gasoline but also across electric cars and hybrids. While Model T’s runaway success was due to its affordable price tag and innovative features, the current EV industry is a different landscape altogether.

Key Challenges That Ford’s Low-Cost EV Platform Will Face

One of the biggest challenges for Ford’s new EV platform will come from Tesla (TSLA), which has commenced the production of its low-cost model but has delayed the ramp-up as it prioritizes deliveries of other models before the EV tax credits expire.

The second risk could come from Chinese automakers. While the U.S. market is currently essentially closed off to Chinese automakers, they are giving Western automakers a run for their money in China, as well as other markets where tariff barriers are not as prohibitive. Notably, Ford has publicly praised Chinese automakers and believes that it needs to compete with them to be successful.

Finally, Ford hasn’t really won any laurels for quality in recent quarters and has been plagued by recurring recalls and warranty costs. During their Q2 2025 earnings call, Ford COO Kumar Galhotra said, “Warranty is the largest component of our competitive cost gap.” He, however, added, “This is a major cost opportunity for us.” While Ford expects warranty costs to come down in the coming years, I would like to see real results, as these issues have simply been too frequent for comfort.

Can Ford Deliver the Next Model T?

Ford will eventually need to execute well, which is a risk to watch out for. Selling a $30,000 electric pickup profitably is easier said than done, and even Tesla wasn’t able to sell its Cybertruck pickup for the kind of prices it announced at launch. As for the electric variant of the Model T, I would argue that Tesla Model 3 and cost-effective EVs from Chinese automakers, especially BYD (BYDDY), already have the crown.

Along with Ford’s ability to come up with an “electrified Model T” equivalent, there is also a question mark over the demand for electric cars in the U.S., as President Donald Trump has done away with his predecessor’s EV-friendly policies.

Farley did admit that the company is taking a risk and there is no certainty about its success. He, however, emphasized, “We’re taking the fight to the competition, including the Chinese, with our teams across the United States: designers in California, engineers from Michigan, American workers right here in Louisville. For too long, legacy automakers played it safe."

As things stand currently, Ford’s EV business continues to lose billions of dollars every year and has accumulated cumulative losses of $12 billion over the last 2.5 years, which have eaten into otherwise strong profits from the legacy business.

Overall, I won’t jump to buy more Ford shares as yet, as the company hasn’t really impressed with execution and quality over the last couple of years.

On the date of publication, Mohit Oberoi had a position in: F , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.