Dear CrowdStrike Stock Fans, Mark Your Calendars for August 27

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)

Cybersecurity has never been more critical, with escalating digital threats pushing governments, enterprises, and individuals to bolster their defenses. Experts predict that the global cybersecurity market will grow from $218.9 billion in 2025 to $562.8 billion by 2032, exhibiting a steady 14.4% compound annual growth rate (CAGR) over the forecast period.

Moreover, as cyberattacks become increasingly sophisticated, the demand for advanced, artificial intelligence (AI)-powered protection is also surging, creating fertile ground for market leaders like CrowdStrike Holdings (CRWD). The cybersecurity giant’s success story hinges on strong demand for its AI-driven Falcon platform, which is designed to detect, prevent, and neutralize threats with real-time speed and precision.

Multi-year contracts, growing demand for Falcon Flex deals, and a robust pipeline of enhancements are further solidifying its position as a cybersecurity heavyweight. That said, as the calendar inches closer to August 27, when CrowdStrike is set to unveil its fiscal 2026 second-quarter results, anticipation is running high. So, here’s a fresh look at this digital defense giant before its next big reveal.

About CrowdStrike and CRWD Stock

Valued at roughly $108.6 billion by market capitalization, Texas-based CrowdStrike is a global leader in cybersecurity, offering a cloud-native platform that helps protect some of the most critical areas of enterprise risk, including endpoints, cloud workloads, identities, and sensitive data. Its Falcon platform leverages the power of the CrowdStrike Security Cloud and AI to identify threats in real-time.

By analyzing attack indicators, threat intelligence, and hacker tactics, along with data from across an organization, it delivers accurate threat detection, automated protection, and quick response times. Built in the cloud with a single lightweight-agent design, Falcon enables quick deployment at scale, strong protection with minimal complexity, and the ability for organizations to see results right away.

Following last year’s high-profile outage incident in July that shook investors confidence, when a flawed update to CrowdStrike’s Falcon Sensor security software crashed approximately 8.5 million Microsoft (MSFT) Windows systems worldwide and sent the stock tumbling to a low of $242.25 in September, the company has demonstrated remarkable resilience, staging an impressive rebound of nearly 81.4% from that level.

And while CRWD stock has experienced some turbulence over the past month due to macroeconomic and business-related factors, its longer-term trajectory remains strong. Year-to-date (YTD), shares of the cybersecurity leader have surged nearly 27.4%, outpacing the S&P 500 Index’s ($SPX) 9.6% gain.

CrowdStrike’s Q1 Earnings Snapshot

CrowdStrike kicked off fiscal 2026 with a mixed bag, posting first-quarter results on June 3. For the quarter ended April 30, 2025, the cybersecurity leader reported revenue of $1.10 billion, up 20% year-over-year (YOY) and in line with Wall Street estimates. Subscription revenue matched that pace, also rising 20% annually to $1.05 billion, underscoring the strength of its recurring revenue engine.

Annual Recurring Revenue (ARR) grew 22% YOY to $4.44 billion, with net new ARR coming in at about $194 million. The company also ended the quarter with a record $4.6 billion in cash and cash equivalents, reinforcing its strong financial position. Profitability, however, told a different story. Non-GAAP net income slipped to $0.73 per share from $0.79 a year earlier, though it still comfortably topped expectations of $0.66.

On a GAAP basis, the company reported a $110.2 million net loss, compared to a $42.8 million profit in the same period last year, as spending increased across sales, marketing, R&D, and administration, partly due to last summer’s widespread software outage. Still, in a show of confidence in its long-term outlook, CrowdStrike’s board approved a share repurchase program of up to $1 billion, reinforcing its commitment to driving shareholder value.

Strategically, CrowdStrike continued to build momentum around Falcon Flex deals, which saw total deal value soar more than sixfold to $3.2 billion YOY. Product innovation remained front and center, with the launch of Falcon Privileged Access, Charlotte AI Agentic Response and Workflows, and advanced AI-powered capabilities in model scanning, Shadow AI detection, and Falcon Exposure Management, positioning the platform for broader enterprise adoption.

CrowdStrike Investors, Mark Your Calendars for August 27

CrowdStrike is set to release its fiscal 2026 second-quarter earnings after the market closes on Wednesday, August 27, and anticipation is building. For the quarter, the cybersecurity leader projects adjusted earnings per share in the range of $0.82 to $0.84, with revenue expected between $1.14 billion and $1.15 billion.

Showing increased confidence, management has raised its full-year earnings guidance to $3.44–$3.56 per share, while holding its revenue outlook steady at $4.74–$4.81 billion. That said, analysts remain watchful, projecting that CrowdStrike will continue to post a loss on a GAAP basis, with Q2 losses forecast at $0.19 per share, reflecting higher operating expenses tied to growth initiatives and innovation investments.

Even so, the company’s expanding Falcon platform, accelerating recurring revenue streams, and steady rollout of advanced AI-driven capabilities are reinforcing its competitive edge in a rapidly growing market, giving investors plenty of reason to keep a close eye on its earnings.

What Do Analysts Think About CrowdStrike Stock?

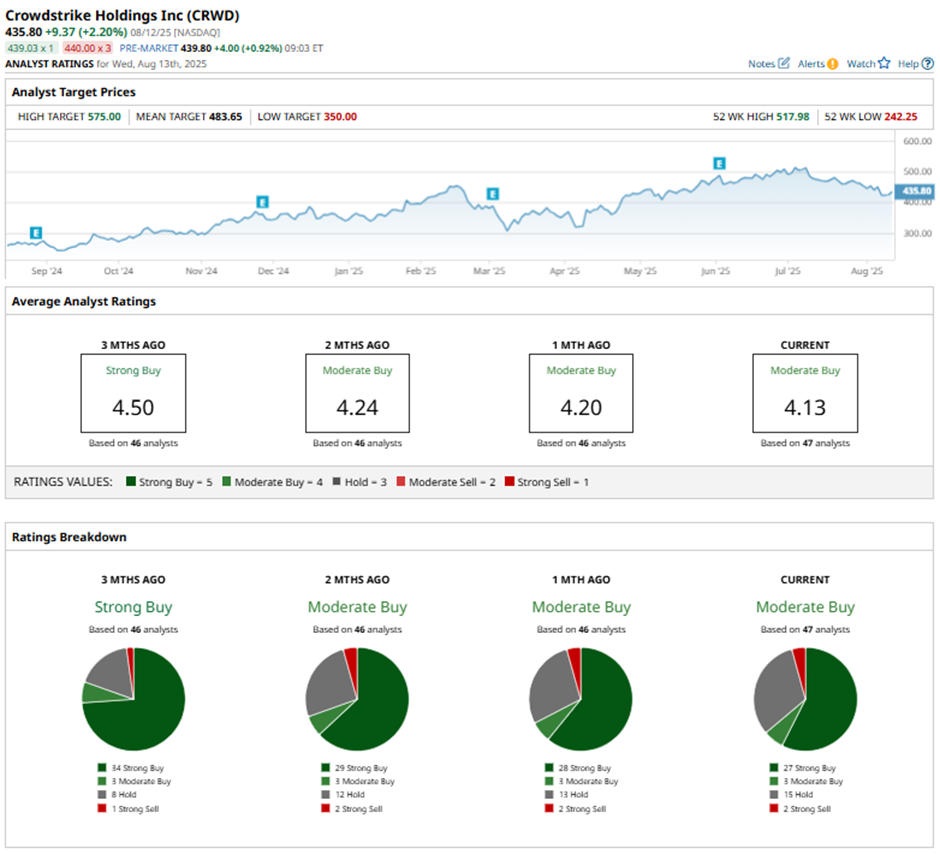

As the company gears up for its next big reveal, Wall Street appears optimistic about CRWD stock, maintaining a consensus “Moderate Buy” rating overall. Of the 47 analysts covering the stock, a majority of 27 analysts have rated it a “Strong Buy,” three suggest a “Moderate Buy,” 15 analysts are playing it safe with a “Hold,” and the remaining two give a “Strong Sell” rating.

CRWD stock’s average analyst price target of $483.65 signals 11% potential upside from current levels, while the Street-high target of $575 indicates that it can rally as much as 32% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.