Should You Buy This ‘Top Pick’ Stock That Wall Street Loves?

AppLovin (APP) was historically known as a leading mobile app company that provided end-to-end software and solutions that helped businesses and app developers market, monetize, analyze, and publish their apps globally. In recent times, the company has shifted toward advertising technology as it divests its gaming development division.

About AppLovin Stock

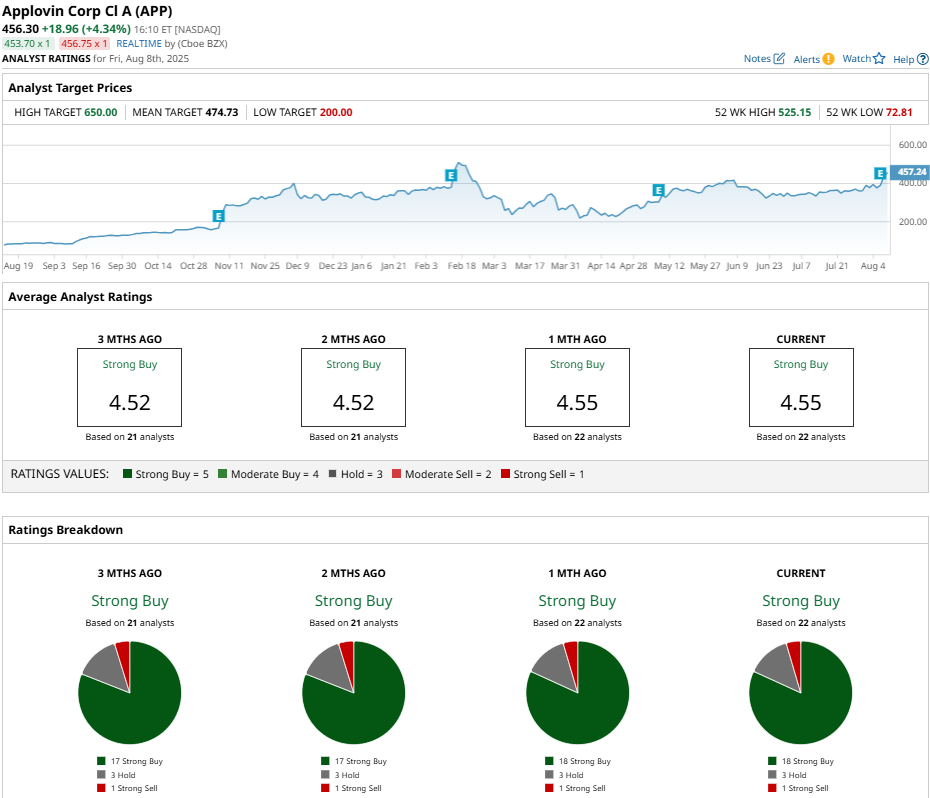

AppLovin’s stock has a YTD return of 42%, dramatically outpacing the S&P 500 Index’s ($SPX) 8.7% climb. Over the past 12 months, AppLovin shares have soared by nearly 500% and are now trading 12% below their 52-week high set in February. The stock is also up 21% in the past 5 days and 33% in a month.

AppLovin’s Stellar Results

AppLovin posted its second-quarter results on Aug. 6, in which it easily outperformed estimates on both earnings and revenue. The company posted earnings of $2.26 per adjusted share, beating Wall Street’s $1.99 per share estimate. Revenue surged 77% to $1.26 billion, topping the analyst estimate of $1.21 billion.

Net income from continuing operations soared 156% to $772 million, driven by strong performance in AppLovin’s advertising technology segment as the business sharpened its focus on AI-powered ad solutions after divesting the gaming apps division.

Other financial highlights include remarkable adjusted EBITDA of $1.02 billion, up 99% year-over-year. AppLovin ended the quarter with $1.2 billion in cash and equivalents as free cash flow spiked 72% to $768 million during Q2.

Looking ahead, AppLovin guided for Q3 2025 revenue between $1.32 billion and $1.34 billion, and adjusted EBITDA of $1.07 billion to $1.09 billion, signaling expectations for continued high growth and sustained healthy margins.

AppLovin Named “Top Pick” by Analyst

AppLovin shares surged following Q2 earnings and received renewed optimism from analysts. Oppenheimer analysts Martin Yang and Jason Helfstein have named the company as their “top pick” with an “Outperform” rating and a price target of $500, indicating upside potential of 9.2%. The analysts highlighted management’s increasing confidence that e-commerce advertising will exceed 10% of total ad revenue this year, pointing toward the AXON Ad Manager launch along with a new self-service portal for U.S. and international clients coming on Oct. 1.

Bank of America also reiterated a “Buy” rating, raising its price target to $580, reflecting 26% upside from the market price. BofA cited several reasons for the raise, such as the introduction of the advertiser referral program slated to launch in October, expanded access for global advertisers, and plans to open AppLovin’s platform to small and medium businesses in 2026.

Lastly, Benchmark Equity Research echoed the positive sentiment, maintaining its “Buy” rating and a price target of $525, signaling 15% upside. Analyst Mike Hickey pointed to rising advertiser confidence, enhanced performance from AXON technology, and broader global reach as reasons AppLovin is well-positioned for sustained revenue and margin expansion.

Should You Buy AppLovin?

AppLovin has strong support from market experts on Wall Street, as seen by the consensus “Strong Buy” rating and a mean price target of $474.73, reflecting upside potential of 4%.

The stock has been covered by 22 analysts with 18 “Strong Buy” ratings, three “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.